Mortgage Broker Glendale CA: Your Neighborhood Partner for Competitive Mortgage Rates

Mortgage Broker Glendale CA: Your Neighborhood Partner for Competitive Mortgage Rates

Blog Article

The Detailed Duty of a Home Loan Broker in Safeguarding the Finest Loan Options and Rates for Your Home Acquisition

A home mortgage broker serves as an important intermediary in the home buying procedure, connecting customers with an array of lending institutions to secure optimal lending alternatives and prices. By assessing individual financial conditions and leveraging market understandings, brokers are well-positioned to bargain desirable terms and streamline the often complex finance application procedure.

Comprehending the Home loan Broker's Duty

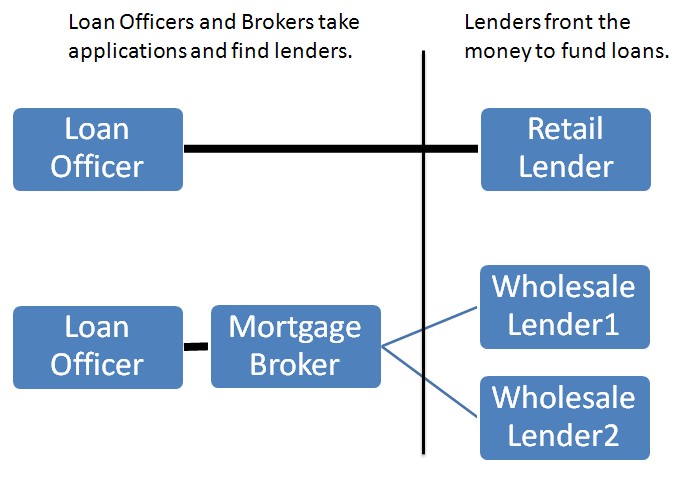

Mortgage brokers regularly serve as middlemans in between lending institutions and debtors, facilitating the financing acquisition process. Their main duty is to evaluate the economic demands of clients and match them with ideal home loan products from a series of loan provider. Mortgage Broker Glendale CA. This needs a thorough understanding of the home mortgage landscape, including various car loan kinds, rate of interest rates, and lender demands

Brokers begin by collecting important economic information from customers, such as revenue, credit rating background, and existing financial obligations. This information is essential for determining the most appropriate lending choices available. As soon as the necessary details is collected, brokers conduct thorough marketing research to determine loan providers that line up with the consumer's requirements, frequently leveraging established partnerships with several economic organizations to secure competitive terms.

Additionally, home mortgage brokers give assistance throughout the entire car loan application procedure. They help customers in completing documentation, ensuring conformity with lending institution needs, and supplying advice on boosting creditworthiness if required. By acting as a bridge between lenders and consumers, home mortgage brokers improve the often-complex process of securing a home loan, inevitably conserving customers effort and time while increasing the probability of safeguarding positive funding terms.

Advantages of Making Use Of a Home Mortgage Broker

Furthermore, home loan brokers have accessibility to a wide selection of loan provider, which allows them to present borrowers with a wide variety of options that they may not find individually. This gain access to can lead to extra competitive rates and terms, inevitably saving customers cash over the life of the loan.

Another advantage is the time-saving facet of dealing with a broker. They deal with the facility documents and negotiations, improving the application process and lowering the problem on borrowers. Furthermore, brokers can use personalized assistance and recommendations throughout the funding trip, cultivating a sense of confidence and clearness.

Just How Mortgage Brokers Compare Lenders

Brokers play a crucial duty in comparing lending institutions to determine the most ideal options for their customers. They have substantial knowledge of the home mortgage market, including various lenders' terms, items, and rates - Mortgage Broker Glendale CA. This knowledge enables them to conduct thorough assessments of the available finance choices based upon the distinct financial circumstances and choices of their customers

Home loan brokers use specialized databases and devices to gather up-to-date details on several lenders successfully. They assess crucial elements such as rate of interest, finance fees, payment terms, and qualification demands. By comparing these elements, brokers can highlight the pros and cons of each alternative, ensuring their customers make informed choices.

In addition, brokers maintain relationships with a diverse variety of lenders, including conventional banks, lending institution, and alternative funding sources. This network allows them accessibility to unique offers and potentially better terms that might not be offered directly to consumers.

Eventually, a home mortgage broker's ability to compare loan providers encourages customers to secure affordable rates and desirable lending problems, streamlining the procedure of discovering the appropriate mortgage solution customized to their individual demands.

The Lending Application Process

Navigating the lending application procedure is a crucial step for clients seeking to secure funding for their homes. This process normally starts with the collection of needed documents, including revenue confirmation, credit scores records, and asset statements. A mortgage broker plays a crucial duty below, guiding clients via the documentation and making sure all information is total and precise.

As soon as the paperwork is gathered, the broker submits the funding application to several lenders, facilitating a competitive environment that can result in far better prices and terms. They also aid clients comprehend numerous financing choices, such as fixed-rate, adjustable-rate, or government-backed loans, ensuring the chosen product lines up with their monetary situation.

Throughout the underwriting process, which involves lenders assessing the customer's creditworthiness and the property's value, the broker acts as an intermediary. They interact updates and attend to any kind of added demands from the lender, improving the process for clients. This support is crucial in reducing tension and confusion, eventually expediting the approval timeline. By leveraging their competence and sector partnerships, home mortgage brokers boost the possibility of an effective financing application, allowing customers to relocate better to homeownership with confidence.

Tips for Picking the Right Broker

Selecting the appropriate home loan broker can considerably impact the general loan experience and result for clients. To guarantee a successful partnership, consider the adhering to tips when choosing a broker.

First, examine their experience and online reputation within the industry. Look for brokers with a tried and tested performance history in securing positive lending terms for customers with varying financial profiles. Mortgage Broker Glendale CA. Checking out evaluations and looking for referrals from relied on resources can give beneficial insights

Second, examine their variety of loan provider connections. A broker with access to multiple loan providers will be better placed to use diverse finance options and my response competitive rates, ensuring these details you find the very best fit for your demands.

Third, ask about their interaction style and accessibility. A responsive broker who prioritizes client communication can aid alleviate stress and anxiety throughout the loan process.

Lastly, ensure they are transparent regarding their costs and payment structure. A reliable broker will provide a clear failure of prices upfront, helping you prevent unanticipated costs later on.

Verdict

By leveraging market expertise and bargaining positive terms, brokers enhance the probability of securing optimal finance alternatives and prices. Selecting the appropriate mortgage broker can lead to a more effective and reliable home purchasing experience, ultimately contributing to notified economic decision-making.

A home mortgage broker offers as a crucial intermediary in the home purchasing process, attaching purchasers with an array of lending institutions to secure optimum loan options and prices.Home mortgage brokers regularly act as middlemans in between lending institutions and borrowers, helping with the finance procurement procedure.In addition, home loan brokers supply support throughout the whole finance application process. By offering as a bridge between consumers and lending like it institutions, home loan brokers streamline the often-complex process of safeguarding a home loan, ultimately conserving customers time and initiative while enhancing the probability of securing positive lending terms.

By leveraging their competence and sector relationships, home mortgage brokers enhance the likelihood of a successful loan application, enabling clients to relocate more detailed to homeownership with self-confidence.

Report this page